Credit Suisse Additional Tier 1 (“AT1s”) bonds issued by Credit Suisse Group AG issued in the amount of c. $17 Bn were wiped out in March 2023.

Over the weekend of March 17 and Switzerland amending domestic legislation over the weekend, a deal was reached on Sunday the 19th to allow UBS to purchase CS.

On the 15th of March, the SNB (“Swiss National Bank”) asserted that the bank met all regulatory capital and liquidity requirements, despite that they would be willing if necessary, to provide liquidity to the bank. The SNB then provided CS with CHF50bn.

However by the 19th or March, the SNB and Swiss Government introduced a new legal order, to enable the government and SNB to provide additional liquidity without causing a bankruptcy event.

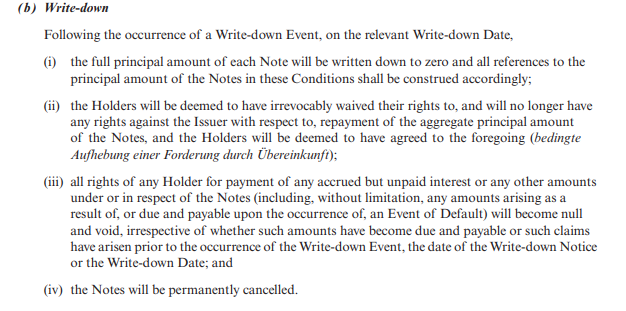

Once can interpret then that the additional liquidity once drawn by CS, demonstrated that the bank was not viable. As a part of the terms and conditions of the AT1 notes, the regulator had the ability to declare a Point of No Viability of the bank and invoke the “Write-down”, as per below in the prospectus of the U.S.$1,650,000,000 9.750 per cent. Perpetual Tier 1 Contingent Write-down Capital Notes, as a result of sucj, there the AT1 bond holders have ended up with a zero recovery.

Southey Capital has experience of working with complex bank liquidations and recovering value from subordinated and junior bank debt. We think there are potentially litigation routes that may result in a recovery of a small amount of value for the written down notes.

Timing wise we expect from our experience in Lehman Brothers subordinated debt and SNS bank, that litigation could take between 10 and 14 years for appeals and claims to be heard.

As an experienced claims investor/trader with deep Swiss connections in terms of trading counter parties and custodial relationships, Southey Capital is uniquely placed to assist sellers of the Credit Suisse AT1s. A list of which appear below.

Provided that a holder is able to prove their ownership via a custody statement or attestation on or before the Write-down date, we will be glad to provide our view on the possible value of the claims.

Bonds for the most part will be blocked in the clearing system (DTC and Clearstream) have made such announcements. However, Southey Capital has experience in dealing with blocked securities and should in most cases be able to help clients move the underlying bonds.

List of affected Credit Suisse AT1s

| Common Code | ISIN | Description |

| International market instruments | ||

| 107695770 | XS1076957700 | CS 6 ¼ PERP REGS |

| 098939458 | XS0989394589 | CS 7 ½ PERP REGS |

| Swiss market instruments | ||

| 187312086 | CH0428194226 | CS 3 ½ PERP REGS |

| 205040340 | CH0494734384 | CS 3 PERP REGS |

| 200737113 | CH0482172324 | CS 5 ⅝ PERP REGS |

| 158411610 | CH0360172719 | CS 3 ⅞ PERP REGS |

| 187922976 | USH3698DBZ62 | CS 7 ¼ PERP REGS / USD 7,25 CREDIT SUISSE GRP (REGS) |

| U.S. market instruments | ||

| 210770283 | USH3698DCV40 | CS 5.1 PERP REGS / USD 5,10 CREDIT SUISSE GRP (REGS) |

| 249569011 | USH3698DDQ46 | CS 9 ¾ PERP REGS / USD 9,75 CREDIT SUISSE GRP (REGS) |

| 185708977 | USH3698DBW32 | CS 7 ½ PERP REGS / USD 7,50 CREDIT SUISSE GRP (REGS) |

| 221517938 | USH3698DDA93 | CS 5 ¼ PERP REGS / USD 5,25 CREDIT SUISSE GRP (REGS) |

| 204425523 | USH3698DCP71 | CS 6 ⅜ PERP REGS / USD 6,375 CREDIT SUISSE GRP (REGS) |

| 227110414 | USH3698DDD33 | CS 4 ½ PERP REGS / USD 4,50 CREDIT SUISSE GRP (REGS) |

| 249644692 | US225401AX66 | CS 9 ¾ PERP 144A / USD 9,75 CREDIT SUISSE GRP (144A) |

| 100338467 | US22546DAB29 | CS 3 ⅞ PERP REGS / USD 7,50 CREDIT SUISSE GRP (144A) |

| 107872035 | US225436AA21 | CS 6 ¼ PERP 144A |

| 185708993 | US225401AJ72 | CS 7 ½ PERP 144A / USD 6,25 CREDIT SUISSE GRP (144A) |

| 187922941 | US225401AK46 | CS 7¼ PERP 144A / USD 7,25 CREDIT SUISSE GRP (144A) |

| 221552865 | US225401AR98 | CS 5 ¼ PERP 144A / USD 5,25 CREDIT SUISSE GRP (144A) |

| 204490350 | US225401AL29 | CS 6 ⅜ PERP 144A / USD 6,375 CREDIT SUISSE GRP (144A) |

| 227136383 | US225401AS71 | CS 4 ½ PERP 144A / USD 4,50 CREDIT SUISSE GRP (144A) |

| 210897267 | US225401AN84 | CS 5.1 PERP 144A / USD 5,10 CREDIT SUISSE AG (144A) |

Please contact us regarding your position